Payments startup Stripe slashes its internal valuation by nearly 30%

Top Ten Reviews Verdict

A development-friendly payment processor, Stripe is swell for high-book businesses looking for the side by side level of customization effectually payment processing software. Don't be put off if you accept less skill; Stripe also offers pre-built solutions that require no coding.

Pros

- +

Flat-charge per unit pricing

- +

Great for developers

Cons

- -

Ameliorate for high-volume business

- -

No customer support phone number

Stripe Payments: Key specs

- Spider web-based SaaS

- Fully customizable programmer tools

- 24/vii support desk

- Customs and online support

- Fast to set up

- Pre-built and Plugin options

- No setup costs or monthly fees

- Transparent pricing

- In-person processing options plus spider web and app

- Over 300 integrations

- Over 100 different currencies accepted/converted

- Available to merchants in over 25 countries

- Fiscal and reporting tools

- Advanced security tools

- PCI compliance at no extra charge

- Additional, customizable functions

Just put, Stripe Payments is 1 of the best credit card processing services effectually. Launched in 2010, Stripe Payments is a developer-friendly payment-processing service that is used by all the big boys of tech, such equally Google, Amazon and Shopify. Its principal selling signal is its customizable API that allows yous to create your ain ecommerce surround with industry-leading programmer tools.

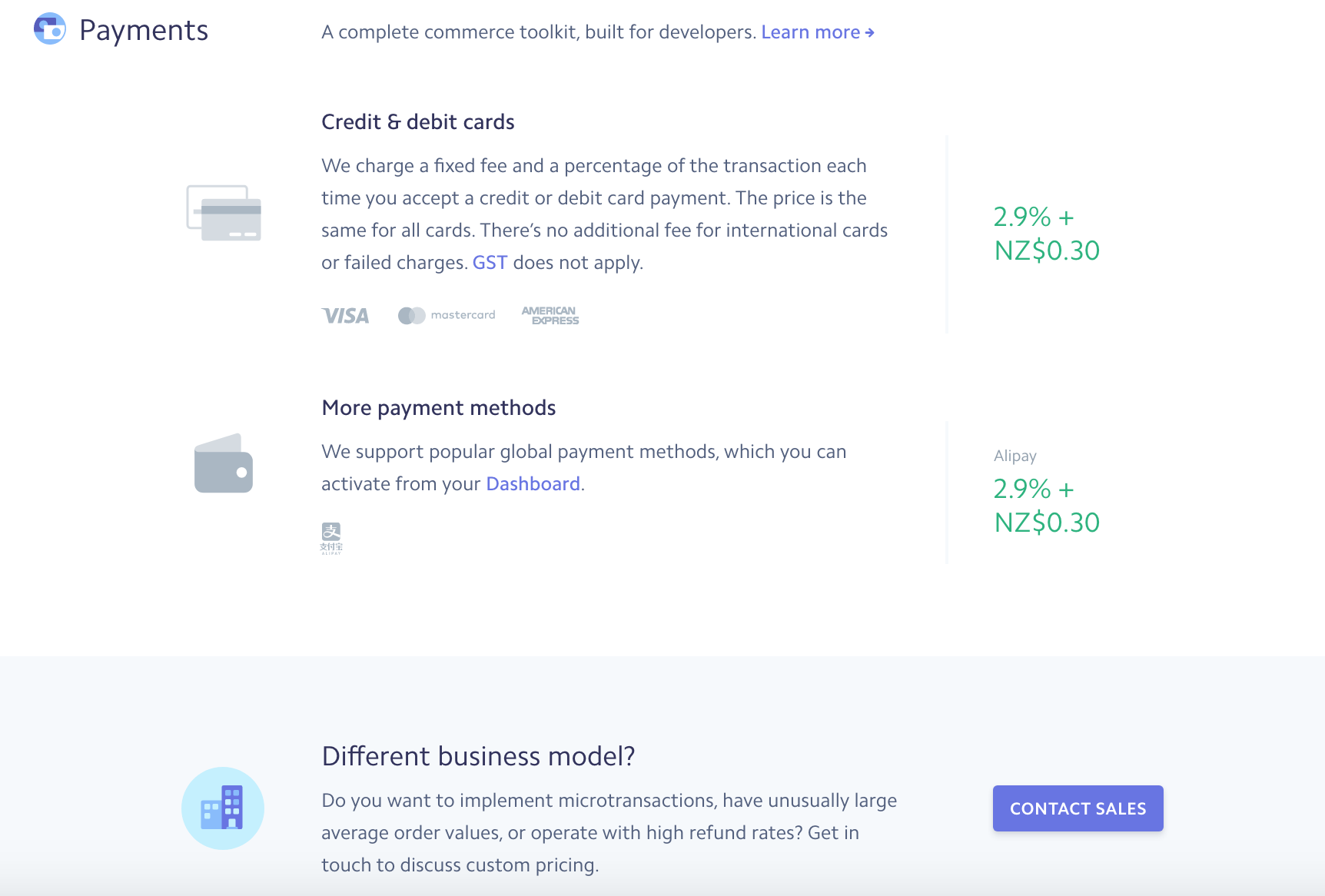

Stripe is piece of cake to gear up with no upfront costs or monthly fees. Like Helcim (opens in new tab), it offers a transparent and competitive pricing structure of two.9% +30c for online payments and ii.7% + 30c for in-person payments. In that location is no penalty for early on termination but you won't see cost-saving discounts until you are processing over US $80,000 per month.

A multifariousness of credit cards are accepted by Stripe, too as over 100 unlike foreign currencies that Stripe converts without additional charge to the merchant.

The customer back up team at Stripe does non have quite every bit good a name as Helcim, with no dedicated customer back up telephone number and some users lament their funds have been frozen in Stripe'south reserve account with limited recourse. More on this farther downward.

Aimed at fast growing medium-sized businesses and already established big players, Stripe is swell for fast, high-volume payment processing and offers a level of customization that will raise your customer experience upward several bars. If you're a smaller merchant nosotros recommend you check out Paypal Business organization (opens in new tab) or Foursquare Payment Processing (opens in new tab) instead.

Looking for pricing data on credit card processing services? Answer the questions below, and our vendor partners volition contact yous with a free quote:

Read as well:

- Best Point of Auction Systems (opens in new tab)

- Best Online Accounting Software (opens in new tab)

Stripe Payments review: Features

- Customizable API

- Subscription-based business tools

- Payment processing plugin

Stripe Payment'south offering is cleanly split between payment processing and developer tools, however the main reason people utilize Stripe is for the latter. If you are a pocket-size to medium business organisation looking for a payment processing integration and then Foursquare payment processing or PayPal Business concern might be more than suited to your needs.

If y'all are after an piece of cake-to-navigate full merchant services platform, check out Helcim. If you are a medium to large business wanting to offer your customers a seamless checkout experience with the next level of tech integration into your existing ecommerce site, and so Stripe is probably the product for you.

Stripe's Application Programming Interfaces (APIs) allow developers to work with a variety of different programming languages (like Java or PHP), to assist businesses build a customized payment portal that works for their clientele.

The range of tools provides flexibility around mutual sticky issues, such equally accepting in-app payments, and work on a solution that is right for your business concern culture, not just one that streamlines the accounting process.

Other Credit Menu Processing Reviews

Subscription-based business tools are also a big selling bespeak for Stripe. Again, a diversity of customizable solutions allow developers to create an ecosystem around a business proposition, offer customers flexibility on how they manage subscription-based products and services, and allowing your business to be responsive to their needs, not a billing cycle.

Stripe also offers a plugin for those who just want to use their payment processing services, simply the toll savings only occur at high volume. If yous are processing more than than U.s. $80,000 a month then a Stripe plugin is worth looking at.

Stripe also offers over 300 product integrations, so if y'all already have a website yous dear with a shopping cart, inventory management, and bookkeeping software platforms, you don't want to modify – Stripe will probably slot in nicely.

Bachelor in more than than 25 countries, and accepting payments in over 100 dissimilar currencies, Stripe is a proficient choice for a large global retailer.

Stripe Payments review: Usability

- Programmer or pre-built pathways

- Variety of add-on features for both

Also every bit the pre-built integrations and the developer options, Stripe likewise offers a option of additional in-house features that could be useful, especially for larger businesses.

Connect, for instance, is a payment platform for large, complex marketplaces that allows you to fourth dimension third-party payouts, customize onboarding and bypass global banking relationships to engage with customers in more than 25 countries. Used past Lyft and Kickstarter, it's a complex interface that speeds upward and simplifies the user experience.

Atlas is a tool that walks United states users through the cyberspace business commencement-up process, taking some of the complexity out of their hands and tracking all the different aspects of the business in 1 place.

Issuing is a brand-new API to help you create physical and virtual cards, while Terminal is a programmable point of sale you can manage in the Cloud. Having all these options, both in-firm and third party, available through one access signal is relative unique and highly compelling.

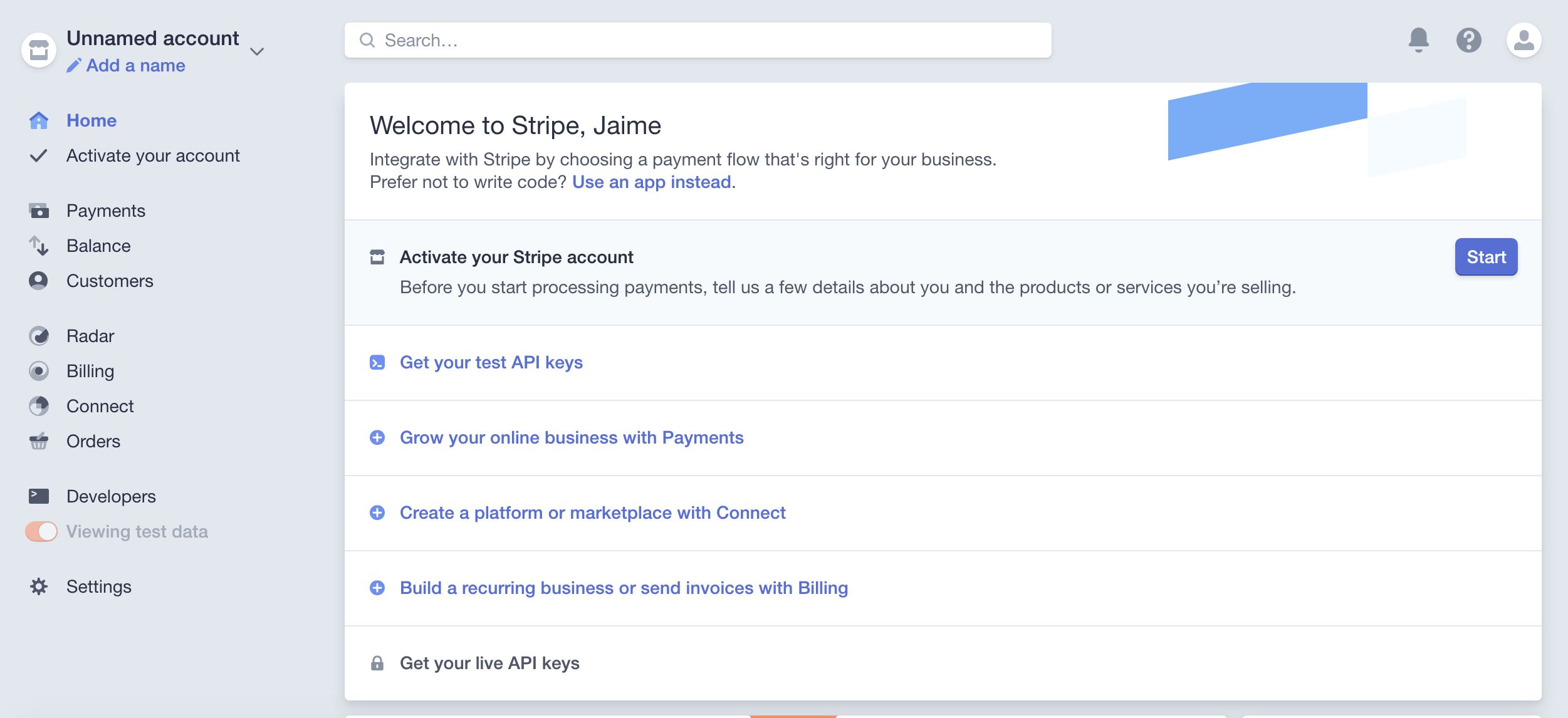

Opening a Stripe business relationship takes simply a few minutes, and the start question you will exist asked is if you want developer tools or pre-built solutions. Both options take you to an like shooting fish in a barrel to navigate dashboard that will exist familiar to anyone who has used a modern CMS.

Choosing the pre-built pathway will open up up a multifariousness of third-party apps for you to choose from, such as the Booxi engagement booking system, Lunatap mobile payments, or 71lbs shipping.

While information technology'due south the programmer tools that really make Stripe special, the pre-congenital pathway option does open up up a whole earth of third-party integration to new and transforming businesses that isn't readily available on other payment processing platforms.

The developer pathway really is merely to be used by the experts. It invites you to access an incredible back catalogue of docs that will help seasoned developers create a completely customizable payment processing solution for your business organization, in almost whatever programming language, that volition also seamlessly integrate with a variety of other third party business organisation products and solutions.

It actually is an heady place to exist for those in the know – but those with less skill tin become easily overwhelmed. It's also of import to note that Stripe is constantly updating its features and docs, so paying a developer upfront to blueprint the payment portal you lot're later on could shackle you to them equally an ongoing price as the Stripe platform evolves.

Stripe Payments review: Performance

- Simple pricing best at volume

- Client intendance problems are still being worked on

- Both pathways offering fast, effective payment solutions

The ultimate describe of Stripe is its ability to be extensively customized. Whichever pathway y'all choose, developer or pre-congenital, Stripe offers an endless range of solutions to meet your private business needs, and if they don't offering information technology, no doubt they're integrated with a 3rd party who will.

If you are just starting out and then this tin can be intimidating and difficult to wrap your head around, simply for larger, more established businesses looking to offer their customers something else, something beyond the framework currently bachelor via nearly payment processing platforms, and then Stripe is the real deal.

Ideally, you lot would have a programmer on staff who could work with Stripe to design something that meets your business needs, and and then exist bachelor to update and maintain it as both your business organisation, and Stripe, move on and grow.

Stripe'south simple pricing structure isn't its main selling signal, just if the developer tools don't bladder your boat then the transparency over service costs will. With no set-up costs or monthly fees, the offer is certainly enticing.

Information technology's important to note though that the payment processing charges cover these costs, and only offer efficiency at high volume. At $lxxx,000 worth of transactions a month, Stripe begins to offer discounts. High-book customers tin also take advantage of customized tariffs.

For lower-volume businesses, you need to look closely to find your sweet spot. A medium-sized business making proficient use of Stripe's developer tools to assist their projected growth might be happy with the tariff, safe in the knowledge this is a payment processing platform that will not only grow with their business, but will come into its own price-wise one time they increase capacity.

However, smaller businesses may benefit more than from Square or PayPal. As a cost comparison, PayPal charges ii.7% per online transaction, while Stripe's fee is 2.9% +30c. If you are turning over US $10,000 worth of transactions a month, especially if each transaction is small, the cost saving could be several hundred dollars a month.

Some other sticking bespeak for some former Stripe customers is the customer service. Where competitor Helcim's honesty and upfront arroyo to customer care has earned them a name every bit the 'nice guys' of payment processing, some Stripe users take complained nigh the misleading '24/7' customer care promised in the advertising.

There is no dedicated customer support phone number, and some customers have previously complained that the client team can be catchy to contact via email and their issues take not been resolved quickly enough. In their defense, Stripe has been working to accost this.

While in that location is still no customer care phone number, you tin can request a call up with a real-time argument of how long you lot volition expect to receive the phone call. An email asking for help placed through the website will also tell you how long you lot tin look to wait for a response, and in that location is an active online community.

Like some other payment processing platforms, Stripe avoids high adventure businesses. At that place are some historical complaints related to this. Information technology seems that some of these businesses, such every bit gambling sites, have been accustomed for an account by the portal, merely after the kickoff few payments have been processed, Stripe has frozen the user accounts and held their funds in their reserve accounts.

The use of a reserve business relationship is quite common, as it bypasses the need for a merchant account (which needs to exist underwritten) to be set up. With a global platform like Stripe, information technology also makes the processing time and systems for users in dissimilar currencies comparable as at that place is no need to involve local banks, or get bogged down in local regulations effectually coin movement.

Some users have complained that Stripe has not been upfront about the way in which it will use the reserve account, or under what circumstances funds might be withheld from businesses.

Again, these complaints are historic and Stripe has worked hard to brand things more than transparent, but if you find yourself unsure about how Stripe volition hold, process and pay out your businesses money, make sure you raise this with the sales team at the start.

Stripe'due south multi-currency options are easy to enable, and its automatic currency exchange saves you both time and money. The diversity of payments accepted, including a number of local payment methods in different countries, is also a huge asset to any globalized business. The company's new hardware improver, Concluding, is useful for ecommerce sites transcending into the physical retail world via merchandise fairs and pop-ups.

Stripe Payments review: Should you buy?

A sophisticated, elegant solution for businesses moving on to the side by side level of customizable solutions, Stripe Payments offers a swell option for organizations operating circuitous marketplaces, and those who have developers on staff to manage the constantly improving Stripe framework.

The integrations, many of which compete with Stripe's ain in-business firm products, show the company is confident in its offering and peachy to support businesses grow in an individual fashion.

Stripe offers an excellent, ultimately customizable solution for larger businesses with a wide range of customers. The ability to be able to write the software into the system you want to offer your clientele – any that may exist – should be very bonny to global businesses that want to offer multi-channel options. Its new hardware service makes it a true omni-aqueduct payment platform provider.

The additional tools, including business organisation start-upward support for entrepreneurs, are unique and inviting, as are the flat charge per unit and transparent payment options and lack of upfront fees.

However, as the price efficiency is only beneficial with volume, businesses processing less than US $eighty,000 per month may wish to look at other providers. Foursquare, for instance, offer toll efficiency at a much lower volume, around U.s.a. $xx,000 per calendar month.

Stripe Payments may not, historically, offer the all-time customer care on the marketplace merely the company has listened to its client base of operations and is improving its offering in this space. The new 24/7 client care desk provides telephone call-back and email back up, and it besides has an agile online community.

What other credit card processing service should you consider?

Every bit we said at the meridian of this review, Stripe Payments is one of the all-time credit bill of fare processing service around but it may not be quite correct for your type or size of business. Of class, there are plenty of other services for you to choose from. Here are the ones we recall are worth consideration and what purpose they are most suitable for; click through for the full review.

Helcim is a great all-round choice; Flagship Merchant Services offers smashing personal service; Fattmerchant is skilful for big volume; Dharma Merchant Services is an upstanding concern choice; Square is best for SMBs; PayPal Business organisation is all-time for micro-businesses; and iPayTotal is the best for loftier risk merchants.

To encounter all these compared in in one case place, read our Best credit card processing service ownership guide.

Looking for pricing information on credit card processing services? Answer the questions below, and our vendor partners volition contact you with a free quote:

- Best Credit Bill of fare Processing Companies

- All-time POS Systems

Source: https://www.toptenreviews.com/stripe-payments-review

Posted by: maherhiscam.blogspot.com

0 Response to "Payments startup Stripe slashes its internal valuation by nearly 30%"

Post a Comment